Tom the Dancing Bug by Ruben Bolling for November 22, 2012

Transcript:

Enjoy this Classic Tom the Dancing Bug Every Thursday Panels from the annals of the Tom the Dancing Bug archive Check back every Friday for a fresh, brand new Tom the Dancing Bug! Tom the Dancing Bug by Ruben Bolling The Bush tax plan proposes to eliminate the insidious DOUBLE TAX! This double tax occurs when income that's already been taxed gets taxed AGAIN hen it's transferred to another person or entity. Look at the following chain of transactions and... CAN YOU SPOT THE DOUBLE TAXATION? $ $ A - Employee receives paycheck and is taxed on the income. B - Employee uses some of that income to pay his plumber, who is taxed on that income. C - Plumber uses some of that income to buy DVDs from shop owner, who is taxed on that income. D - Shop owner uses some of that income to make a car payment to his bank, which is taxed on that income. E - Bank uses some of that income to pay a dividend to stockholder, who is taxed on that income. F - Stockholder uses some of that income to tip caddy, who is taxed on that income... THAT'S RIGHT, THE ANSWER IS E (the transaction that involves the taxation of wealthy people!) The payment of DIVIDENDS is the unique phenomenon in which the I.R.S. taxes income that's been previously taxed by another, separate person or entity! To protest this unfair tax, send your non-tax-deductible donation to: Nerrex, Inc. Corporate H.Q. P.O. Box 417, Bermuda

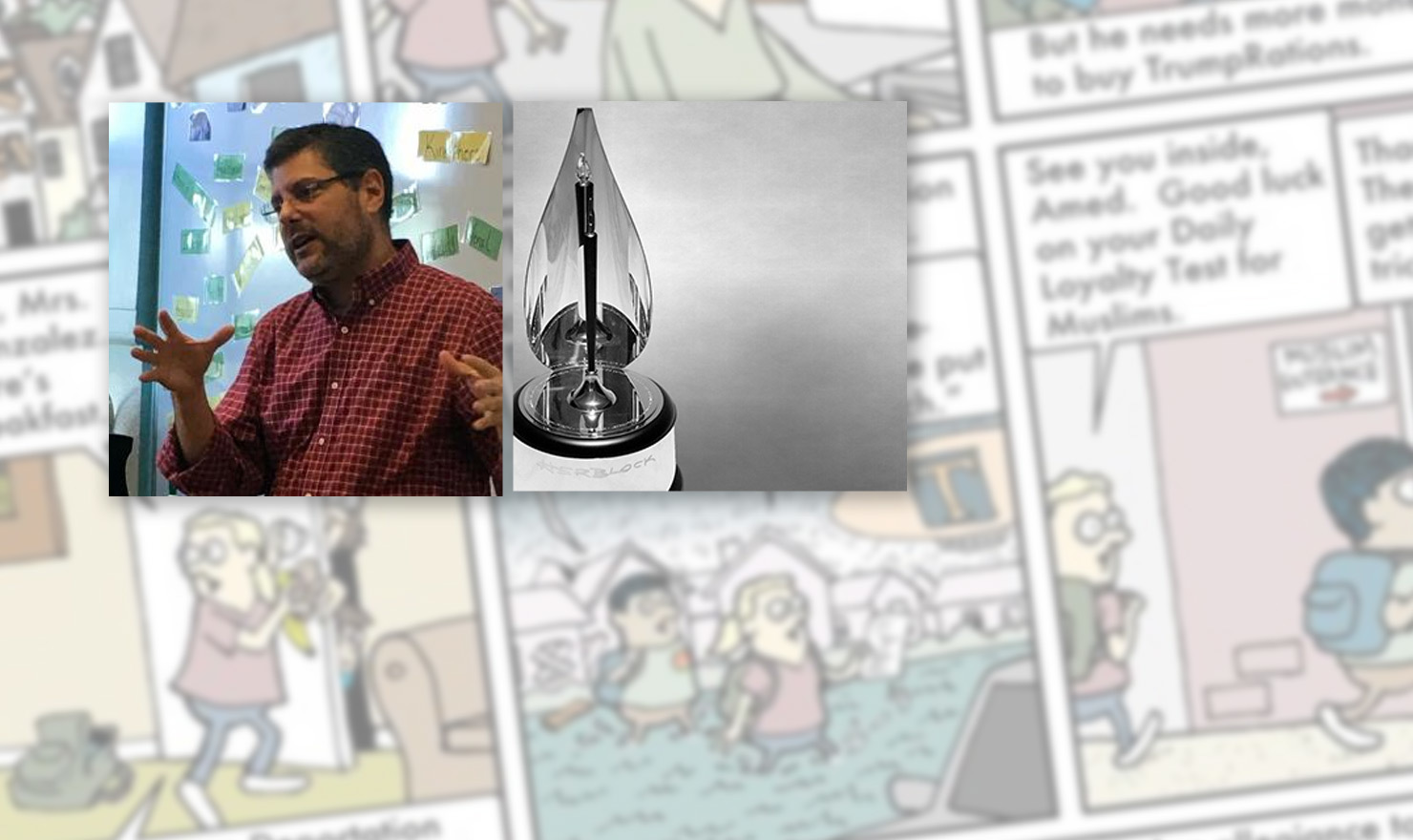

!['Tom The Dancing Bug' Turns 20: Ruben Bolling's Award-Winning 2017 [Interview]](https://assets.gocomics.com/uploads/blogs/blog_image_large_4068_7479_Tom_The_Dancing_Bug_20th_Anniversary_201706271720.jpg)

jfromlrgo about 12 years ago

F) Only if the caddy is stupid enough to declare the “full” amount to the IRS. When I delivered furniture I never got a tip as far as the IRS was concerned.

Dtroutma about 12 years ago

Been using this comparison for a long time, but of course only “dividends” are actually taxed at all, RIght?? Oh but the “double down” dummies “buy” it.

tecumseh18 about 12 years ago

monsaid, you’re confusing the argument against taxing dividends with the argument against taxing capital gains. No serious person has a problem with taxing dividends, or interest received on loans or bank deposits for that matter. They all involve investing YOUR OWN MONEY. Why not tax someone in the money-lending business?

Anyway, the real double taxation issue is whether corporate profits AND dividends should be taxed. I’ve heard even left-wingers argue against corporate profits tax, but in favor of attributing corporate income to shareholders regardless of whether or not a dividend is paid.

rini1946 about 12 years ago

lot of liberals If I own a business I report the profit to the irs and they tax it when I take it home thats it no more taxes on that profit. when you own stock you own the company and they have paid taxes on the profit and what is left is giving to the owners and then they are taxed on it again double taxes period. If you people get you head out of you butt you would see that. Not all rich people own stock a lot of retirement funds and retired people own stock and they are not rich just did not buy that 50 inch tv or ate out every day and saved some money ruben good job but some of these people can see but are blind.